IT Tools

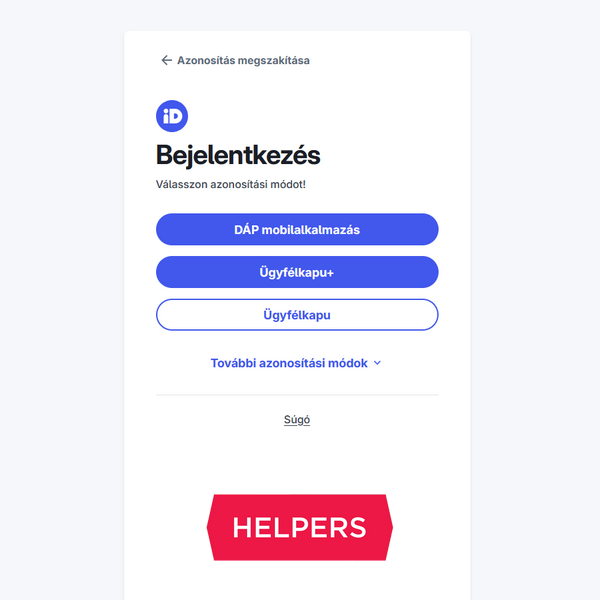

If you are a tax resident in Hungary, you have until May 20, 2025 to submit your tax returns for the year 2024. If you have an Ügyfélkapu or DÁP access, this will take only a few minutes, as the whole procedure is online.

The post Tax returns in Hungary in 2025 appeared first on Helpers Finance.

While the Helpers website is already a great resource regarding residency and work permit applications in Hungary, we have decided to build a new website that would be dedicated to the needs of employers and HR specialists who would like to bring foreign employees to Hungary, available in English and Hungarian. Now we need your input to make it as useful to you as possible.

The post Help us create an expert resource for employers and HR specialists appeared first on Helpers Hungary.

Online purchases take a more and more of the economy in Hungary as well as around the world. Read on to get familiar with the latest statistics, and consider how these numbers relate to your business in Hungary.

The post Online purchases in Hungary appeared first on Helpers Finance.

When you operate a Hungarian company, you will have to pay business taxes in Hungary. While your accountant can calculate the taxes you need to pay, it is you (or one of your authorized employees) who will need to pay each tax to the Tax Authority.

The post How to pay your business taxes in Hungary? appeared first on Helpers Finance.

In another step towards the digitalization of administration in Hungary, real estate transactions can now be registered electronically. The new system is expected to replace the old paper-based system by Q4 2025.

The post New electronic administration system for real estate transactions in Hungary appeared first on Helpers Hungary.

With the season for filing your tax returns for 2024 coming up in Hungary, we have prepared you a quick summary of deadlines, complete with explanations of the most important concepts.

The post Filing your tax returns in Hungary in 2025 appeared first on Helpers Hungary.

According to the latest surveys, cash remains a strong element of Hungarian economy, while digital payment methods are slowly gaining ground.

The post Cash and digital payment in Hungary appeared first on Helpers Finance.

In Hungary, the address of a natural person is part of their core data. Most third-country nationals living in Hungary can prove their address with a QR code featured on an accommodation slip, while some of them are eligible for an address card alongside Hungarian citizens.

The post All about the Hungarian address card appeared first on Helpers Hungary.

Starting from 16 January 2025, the old Ügyfélkapu system will no longer function as an access to government portals in Hungary. Instead, you should switch either to Ügyfélkapu+ or the DÁP app to access electronic administration.

The post What is the DÁP app? New form of gateway introduced to electronic administration in Hungary appeared first on Helpers Hungary.