HR

Quiet vacationing is a trend that gets more and more prevalent in the U.S. It refers to taking time off without formally reporting it, often by pretending to still be working. Obviously, this is not good for business, but the reason why is more complex than it seems at first glance.

The post What does quiet vacationing mean for your Hungarian company? appeared first on Hungarian Work Permit.

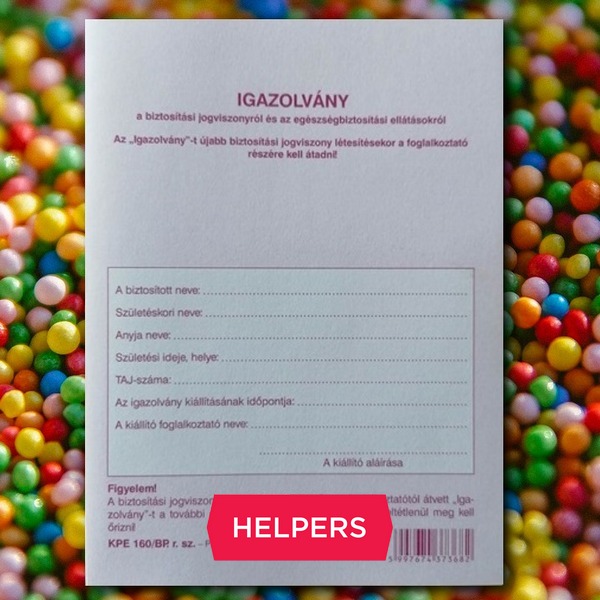

In Hungary, employers are required to make sure that their employees are healthy and stay healthy while they are performing work for the company. This is done through regular health checkups which are organized by the employer.

The post Regular health checkups at the Hungarian workplace appeared first on Helpers Hungary.

In Hungary, child-rearing is supported in various ways. One of them is a lengthy maternity leave discussed in our previous article. Another one is the system of child benefits available to new mothers and parents.

The post Child benefits in Hungary appeared first on Helpers Hungary.

If you have employees working for your Hungarian company, they will be entitled to paid time off in line with Hungarian labor law. PTO is not an option: you as an employer must make sure that your employees have taken all their PTO by the end of each year.

The post Paid time off and unpaid leave at your Hungarian company appeared first on Hungarian Work Permit.

When a child is born, mothers are eligible for 24 weeks of maternity leave in Hungary. During and after their leave, they may receive maternity benefits from the state. At the same time, both parents become eligible for extra days of PTO and other forms of leave and benefits.

The post Maternity leave and benefits in Hungary appeared first on Helpers Hungary.

Summer is here, and air-conditioners are running in most workplaces. The temperature in the office doesn’t just affect comfort – it also impacts your employees’ health and productivity. That’s why there are rules in place to make sure workplace temperatures stay safe and appropriate.

The post How to keep your office cool and comfortable in summer appeared first on Company Formation.

To reduce the gender pay gap in the EU, a new payment transparency directive is on its way, which should be implemented in all member states by June 2026. In turn, employers will need to implement various measures to increase transparency, while the new rules will improve employees’ position in bargaining for better salaries.

The post New payment transparency rules coming in 2026 appeared first on Helpers Finance.

As your Hungarian company is growing, you might want to distribute leadership duties and increase the number of executives either by way of promoting existing employees or employing executives as new hires. However, executive employees have different rights and protections, while a promotion may affect the work permit status of an employee.

The post Employing executives at your Hungarian company appeared first on Hungarian Work Permit.