With the mandatory introduction of two-factor authentication in governmental administration, accountants are facing a new challenge come 2025. Read on to learn how 2FA for the Client Gate can cause issues in accounting.

The post 2FA for the Client Gate interferes with accounting in Hungary appeared first on Helpers Finance.

Paid time off or PTO is an integral part of labor law in Hungary. Workers need time off to rest, to heal, or to take care of emergencies without compromising their livelihood. The number of days available for PTO each year depends on various factors.

The post Paid time off or PTO in Hungary appeared first on Helpers Finance.

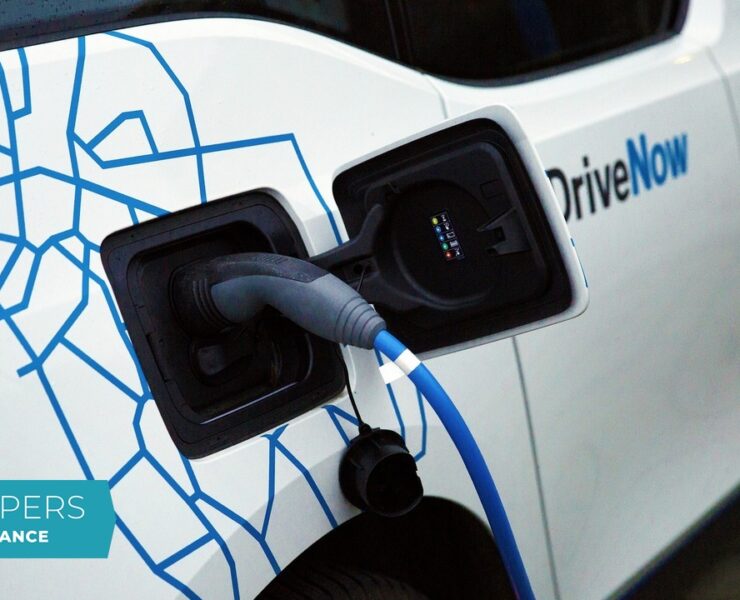

To counter the negative effects of the import of heavily subsidized Chinese electric vehicles, the EU is introducing punitive levies from November 2024.

The post EU to introduce punitive levies on Chinese electric vehicles appeared first on Helpers Finance.

Because of the Christmas holidays, two working Saturdays are coming up in December. It is not too early to start planning: make sure you have a plan for opening and closing times for your business.

The post Working Saturdays in Hungary in 2024 appeared first on Helpers Finance.

Qvik payment is free of transaction fee, which can significantly reduce the costs of sellers, while it offers customers the convenience of paying with a bank card.

The post Qvik payment: New mobile payment option in Hungary appeared first on Helpers Finance.

Retirement age in Hungary is 65 years, after which everyone can receive pension from the state. However, people are allowed to work even if they pass that age. In fact, employing pensioners is encouraged by various tax benefits.

The post Why to employ pensioners at your Hungarian company? appeared first on Helpers Finance.

Fall and the new school year is on us. This is the season for new rentals and rental renewals, so we prepared a quick summary about rentals, taxes, and VAT on rentals in Hungary. Taxes depend on who is renting out the property As a rule of thumb, the taxes you pay depend on the …

The post VAT and other taxes on rentals in Hungary appeared first on Helpers Finance.

If you are in the middle of hiring a person like this, you should consider choosing a starting date still in July, so you can still take advantage of the tax benefit of labor market entrants while it is available.

The post Tax benefit of labor market entrants reduced from August 2024 appeared first on Helpers Finance.

Most Hungarian small and medium sized companies do not need an auditor. However, when they grow to a certain size, they will be required by law to hire an auditor to make sure all their books are in order.

The post When will your Hungarian company need to hire an auditor? appeared first on Helpers Finance.

ONYA is the online portal for reporting your Hungarian income and other information relevant to your taxes. While it is available only in Hungarian, it might make your life easier if you are trying to navigate Hungarian taxation on your own.

The post ONYA user guide – how can ONYA help with your taxes in Hungary? appeared first on Helpers Finance.