Calculator

If you are in the middle of hiring a person like this, you should consider choosing a starting date still in July, so you can still take advantage of the tax benefit of labor market entrants while it is available.

The post Tax benefit of labor market entrants reduced from August 2024 appeared first on Helpers Finance.

Do you want to have access to your tax related information on the go? Then the official mobile app of NAV, the Hungarian Tax Authority is for you. For now, the app NAV-Mobil is available only in Hungarian, but it might still be a valuable tool for you.

The post NAV-Mobil – the official app of the Hungarian Tax Authority appeared first on Helpers Finance.

When you operate a Hungarian company, planning your budget should include planning for payroll costs. Depending on your business model, you might need to apply wage supplements from time to time, so it is worth getting familiar with them.

The post Wage supplements and overtime in Hungary appeared first on Helpers Finance.

Are you new to business? Or maybe just to flat-rate taxation? Either way, you might wonder how and when you are supposed to first pay the local business tax, since it is normally calculated based on the tax of the previous year – and you might not have a previous year.

The post Local business tax deadlines for new businesses appeared first on Helpers Finance.

While flat-rate taxation is a cost-effective alternative for self-employed KATA orphans from September, it is not available for limited partnerships. Instead, they may consider whether TAO, KIVA and/or EKHO are suitable alternatives for their company. Limited partnerships in Hungary The limited partnership (“betéti társaság” or “BT”) in Hungary is a popular form of company for …

The post KATA alternatives for limited partnerships: TAO, KIVA, EKHO appeared first on Helpers Finance.

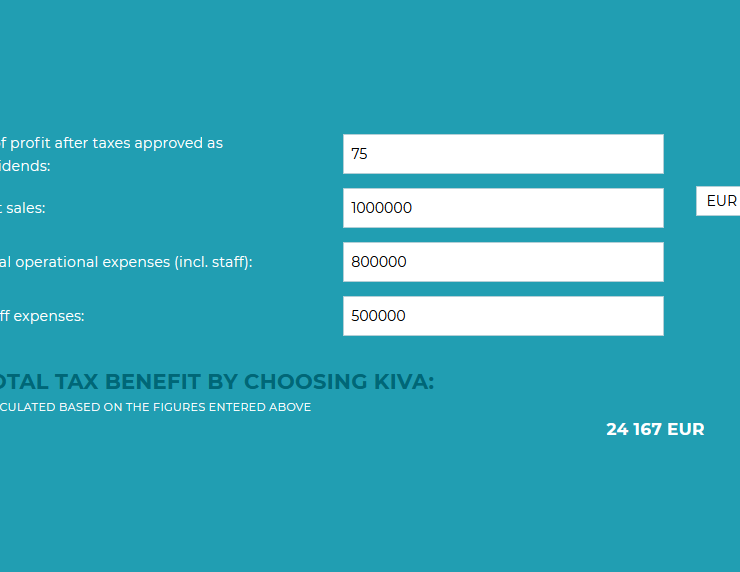

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

The post Explore the new small business tax calculator appeared first on Helpers Finance.

We proudly announce that our English-language online Hungarian salary calculator is now available. Check out the Hungarian salary calculator Designed for foreign-owned companies Our clients are mostly foreigners operating a company in Hungary. As such, for them the most important pieces of information are the company cost and the net salary: how much hiring an …

The post Hungarian salary calculator available – in English, online appeared first on Helpers Finance.