Bank Account

The yellow check in Hungary is in fact a postal payment slip that lets people without a bank account complete payments. Learn how it works.

The post The “yellow check”: postal payment slips in Hungary appeared first on HELPERS.

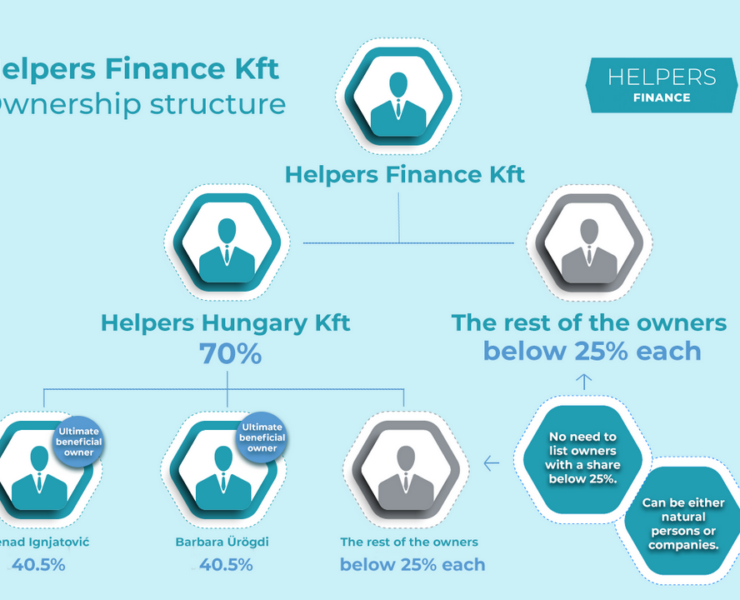

You are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of a chart that starts with your Hungarian company and ends in the ultimate beneficial owners.

The post How to present the ownership structure of your Hungarian company? appeared first on Helpers Finance.

Money left on a regular bank account pays hardly any interests, while making investments through a securities account can even increase their value, especially in a high inflation environment like that of Hungary these days.

The post What are the advantages of opening a securities account? appeared first on Helpers Finance.

Starting a business in Hungary is very easy. Registration is done in 4-5 business days, and you immediately get an EU VAT number as well, so you can start trading in no time. You only need a bank account to manage your finances, and you are ready to go. But what else to consider before setting up? Here is a list of the most important things – with which our team will be happy to help.

The post 11+1 things to consider before starting a business in Hungary appeared first on Company Formation.

Are you already a resident of Hungary? Currently employed and want to do something else on the side? Followed your spouse on family unification and want to work, but you do not have a work permit yet? Becoming a freelancer in Hungary might be the way. Have a summary of aspects to consider.

The post 10+1 things to consider before becoming a freelancer in Hungary appeared first on HELPERS.

When doing business with foreign clients, it might come in handy if your Hungarian company has a foreign corporate bank account. There is no limitation on the number of corporate bank accounts you can set up, just make sure your Hungarian bank account knows about all of them.

The post What to watch out for when setting up a foreign corporate bank account? appeared first on Helpers Finance.

Normally, you are supposed to pay your taxes in HUF by wire transfer from your Hungarian corporate bank account, adding your VAT number as a comment.

The post How to pay your company related taxes in Hungary appeared first on HELPERS.

New opportunity to save on taxes in Hungary: If your Hungarian company does most of its business in foreign currencies, you can avoid exchange fees by paying your taxes directly in EUR or USD. The new rules apply to TAO and HIPA (the regular corporate tax and the local business tax), and will be relevant …

The post Pay your taxes in foreign currencies from 2023 appeared first on Helpers Finance.

To counter the effects of inflation, new government securities are introduced in Hungary, while existing ones are also updated to provide safe options for savings and investment in Hungary. Announcement by the Government Debt Management Agency Starting from 19 September, interest rates will be increased as follows: One Year Hungarian Government Securities (EMÁP): from 4.75% …

The post New government securities available to natural persons in Hungary appeared first on Helpers Finance.

Every Hungarian company must have a local bank account, which you can only open in person. In a previous article, we explained what Hungarian banks expect from foreigners and how you can prepare for your bank appointment and the KYC procedure. This time, we focus on the arrangements that should make your bank account opening …

Bank account opening: planning your trip to Hungary Read More »

The post Bank account opening: planning your trip to Hungary appeared first on Company Formation.