Compliance

Company modification is the official procedure through which a lawyer helps you change the core data of your Hungarian company with the Company Registry. One of the cases you need this procedure is when there is a change to the address of any of the owners and main executives.

The post Company modification tips Hungary – Address change appeared first on Helpers Hungary.

Company modification is the official procedure through which a lawyer helps you change the core data of your Hungarian company with the Company Registry. One of the cases you need this procedure is when there is a change to the address of any of the owners and main executives.

The post Company modification tips Hungary – Address change appeared first on HELPERS.

Company modification is the official procedure through which a lawyer’s help you can change the core data of your Hungarian company with the Company Registry. One of the cases when you need this procedure is when your company is hiring an auditor.

The post Company modification tips Hungary – Hiring an auditor appeared first on Helpers Hungary.

Company modification is the official procedure through which a lawyer’s help you can change the core data of your Hungarian company with the Company Registry. One of the cases when you need this procedure is when your company is hiring an auditor.

The post Company modification tips Hungary – Hiring an auditor appeared first on HELPERS.

When you set up your business in Hungary, your company will need a name which clearly identifies it and which distinguishes it from competitors. A Hungarian company name must be unique, correct, and appropriate. What does that mean? Read on to find out.

The post Choose the right name for your Hungarian business appeared first on Company Formation.

While fall is warm and mild this year, we are already in the season where heaters will inevitably be switched on all over Hungary. Since temperature is an essential element of an appropriate working environment, heating at the office will play an important role in the health as well as the productivity of your employees.

The post Heating at the office – winter work safety in Hungary appeared first on Helpers Hungary.

While fall is warm and mild this year, we are already in the season where heaters will inevitably be switched on all over Hungary. Since temperature is an essential element of an appropriate working environment, heating at the office will play an important role in the health as well as the productivity of your employees.

The post Heating at the office – winter work safety in Hungary appeared first on HELPERS.

The number of yearly tax inspections conducted by the Hungarian Tax Authority has been steadily increasing over the past few years. The most popular tax inspected continues to be VAT, since it is a major contributor to the national budget. If your company operation is compliant with regulations, you have nothing to worry about.

The post Hungarian Tax Authority conducts more tax inspections appeared first on Helpers Finance.

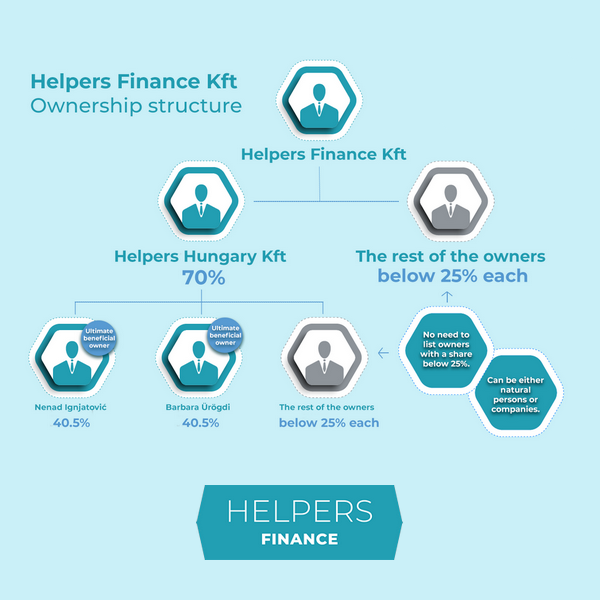

You are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of a chart that starts with your Hungarian company and ends in the ultimate beneficial owners.

The post How to present the ownership structure of your Hungarian company? appeared first on Helpers Finance.

Whether it is because of increased turnover or employees taking their holidays, your business might be in need of temporary workers. You have various options, just make sure to declare the employment correctly to avoid fines.

The post Summer is the season for temporary work – make sure to declare it appeared first on Helpers Finance.