Business

For the last few months, price caps have been in force in Hungary for fuels and some basic grocery items. While originally they were supposed to be expire in May 2022, the price caps were extended until 1 July 2022. Get an overview of the current situation, and see how it affects your Hungarian company.

The post Price caps staying in Hungary until 1 July 2022 appeared first on Helpers Finance.

hen you set up a company in Hungary, it will need a name that distinguishes it from other ventures. Learn what the compulsory elements of a company name in Hungary are, and choose the perfect name.

The post How to choose a company name in Hungary appeared first on HELPERS.

Stagflation is when economic growth slows down while inflation continues to increase. Developments of the last few years, most prominently the COVID pandemic and the war in Ukraine are making stagflation an increasing possibility. What do projections say, and how can you best prepare your Hungarian business?

The post Impending global stagflation and its effects on your business appeared first on Helpers Finance.

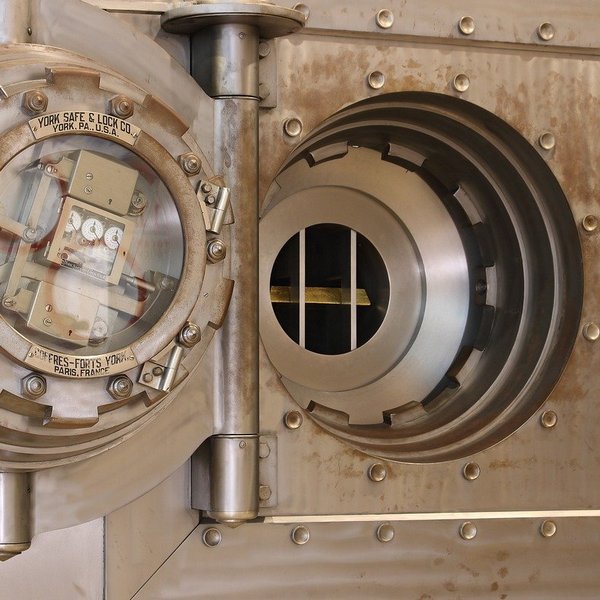

Every Hungarian company is required by law to have a Hungarian corporate bank account. But how does banking work in Hungary, and which aspects should you consider to make your banking cost-effective as well as effortless?

The post How to cut costs on corporate bank accounts in Hungary appeared first on Helpers Finance.

These days, banking is made simple through online platforms and mobile phone apps. But how exactly does money transfer work in Hungary? What is IBAN, SWIFT, and OBA?

The post Banking in Hungary appeared first on HELPERS.

Cryptocurrencies are stateless, decentralized, anonymous digital currencies, which have often been viewed as a kind of doomsday insurance. They were supposed to be resilient to the fluctuations of the real world, but they have not exactly delivered on that promise as the new dominant international asset.

The post The crypto landscape in times of war appeared first on Helpers Finance.

The war in Ukraine creates uncertainty in the entire region. Scarcity and instability hasten inflation, which at this scale is capable to affect the global economy. These effects are most obvious in the changes to foreign exchange rates.

The post Foreign exchange rates affected by Ukraine war appeared first on Helpers Finance.

When you have funds in excess, it is usually best not to just let them lie around in your pocket or on a bank account, but to make some kind of investment to ensure that your money retains its value, or even turns a profit. But from which investments can you actually expect that, especially in uncertain times, when war looms on the horizon? Learn which are the safest kinds on investment in such cases.

The post Safe investment when war is coming your way appeared first on Helpers Finance.

As a fallout of the current war between Ukraine and Russia, the Central Bank of Hungary (Magyar Nemzeti Bank or MNB) has recently announced that Sberbank Hungary will be liquidated. Bank deposits are insured by OBA and will be returned to customers; corporate customers should find a new financial provider as soon as possible.

The post Sberbank liquidation and OBA deposit insurance appeared first on Helpers Finance.

Despite recent rumors, Revolut is not moving out of Hungary. However, Revolut’s Hungarian HUF bank account is being cancelled as of 1 April 2022, which is most relevant for employers sending salaries to Revolut accounts and people spending HUF in Hungary. Get an overview from us, and see if you are affected.

The post What is happening to the Hungarian HUF bank accounts of Revolut? appeared first on Helpers Finance.