Bank Account

Cash transactions in Hungary are limited only for B2B transactions; here the limit is HUF 1.5 million in any calendar month regarding each contract. There are no limits on B2C transactions, although they require additional paperwork above certain thresholds depending on the products sold. You will also need to set a limit for yourself regarding how much cash you may handle at your Hungarian business.

The post Limits on cash transactions at your Hungarian business appeared first on Helpers Finance.

At a Hungarian business, every money transaction needs to be documented. This is true not only for electronic or wire transactions, but also for cash transactions. If your business manages cash, you will need to have a petty cash log and appropriate documentation even if you do not have a regular cash register. Additionally, petty cash registers are often scrutinized during tax audits, so they must be up to date.

The post Petty cash and cash limitations in Hungary appeared first on Helpers Finance.

Once you set up your Hungarian company, you will be able to take care of most administrative tasks online. Hungarian administration is highly digitalized, making business operation more transparent. Read on to get familiar with the tools for online administration in Hungary.

The post Online administration for Hungarian companies appeared first on Company Formation.

When you operate a Hungarian company, you will have to pay business taxes in Hungary. While your accountant can calculate the taxes you need to pay, it is you (or one of your authorized employees) who will need to pay each tax to the Tax Authority.

The post How to pay your business taxes in Hungary? appeared first on Helpers Finance.

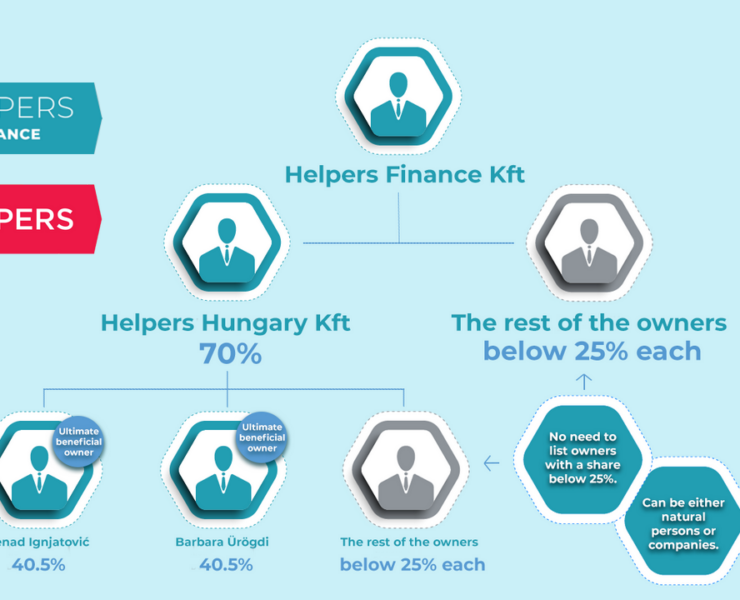

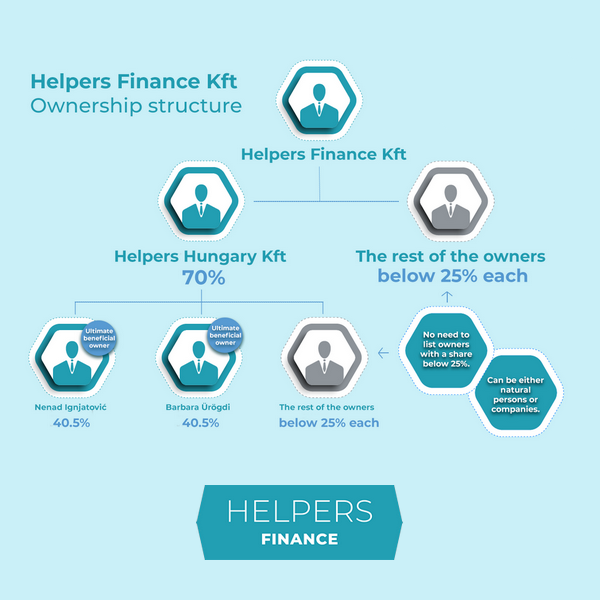

Transparency is a key value in the European Union. When you set up your Hungarian company and want to register for mandatory services, you are expected to present the ownership structure of the company in a transparent way.

The post Transparent presentation of the ownership structure of your Hungarian company appeared first on Company Formation.

The yellow check in Hungary is in fact a postal payment slip that lets people without a bank account complete payments. Learn how it works.

The post The “yellow check”: postal payment slips in Hungary appeared first on HELPERS.

The yellow check in Hungary is in fact a postal payment slip that lets people without a bank account complete payments. Learn how it works.

The post The “yellow check”: postal payment slips in Hungary appeared first on Helpers Hungary.

You are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of a chart that starts with your Hungarian company and ends in the ultimate beneficial owners.

The post How to present the ownership structure of your Hungarian company? appeared first on Helpers Finance.

Money left on a regular bank account pays hardly any interests, while making investments through a securities account can even increase their value, especially in a high inflation environment like that of Hungary these days.

The post What are the advantages of opening a securities account? appeared first on Helpers Finance.

Starting a business in Hungary is very easy. Registration is done in 4-5 business days, and you immediately get an EU VAT number as well, so you can start trading in no time. You only need a bank account to manage your finances, and you are ready to go. But what else to consider before setting up? Here is a list of the most important things – with which our team will be happy to help.

The post 11+1 things to consider before starting a business in Hungary appeared first on Company Formation.