Accounting and Finance

Your accountant should know about all bank accounts you have registered with your Hungarian company, regardless whether it is at a Hungarian or a foreign bank. Check your records, and make sure your accountant knows about all your company bank accounts.

The post Foreign bank accounts for your Hungarian company appeared first on HELPERS.

The short answer is: all of them. Your company bank account is part of the ID of your company. Your company remains compliant with Hungarian regulations if you make all transactions through a bank account registered for your Hungarian company.

The post Which transactions must go through your company bank account in Hungary? appeared first on HELPERS.

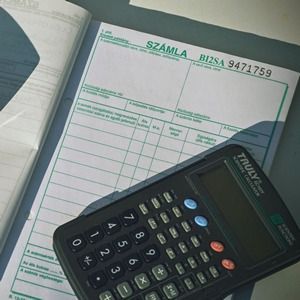

If you operate a Hungarian company, whenever you sell something, you have to issue an invoice. But what kind of data should you include? Read on, and learn what to write on the invoice in Hungary! Data of your company You have to include the basic data of your company, so no one can have […]

The post What to write on the invoice in Hungary? – Accountancy quick guide appeared first on HELPERS.

When you have a business idea you want to make reality, you don’t want to waste time with unnecessary administration. Hungary offers the fastest company incorporation procedure in Europe. Have your company incorporated in just a few days Founding a limited liability company in Hungary only takes 2-3 business days. Our lawyers prepare all necessary […]

The post Fastest incorporation in Europe appeared first on HELPERS.

Your passport is the only document you need to bring. For nationals of many European countries, an ID card might be enough. However, be sure to check with us in advance if this applies to you.

The post What documents are required for company formation in Hungary? appeared first on HELPERS.

Setting up a company in Hungary is fast and uncomplicated. We will walk you through the process in detail in this post. Rest assured, we’ve got your back!

The post Setting up a Hungarian Company appeared first on HELPERS.

The Helpers Virtual Office and Accountancy combined are the best services to relieve as many burdens from Hungarian company owners as possible. Now new procedure allows your Hungarian Accountant to sign certain payroll related documents, making your life even easier.

The post Authorize your accountant to sign payroll documents for you appeared first on HELPERS.

Only 9% is payable regardless of how much your turnover or profit is. Although some countries apply higher corporate tax rates to companies with higher profit, there is no such rule in Hungary. This means that you can take advantage of the lowest corporate tax rate in Europe regardless of your business volume.

The post The lowest corporate tax rate in Europe appeared first on HELPERS.

The Hungarian Tax Authority introduced the representation tax in order to avoid companies buying personal supplies on company money, this way reducing the company’s profit (and paying less as corporate tax).

The post The so-called “representation tax” in Hungary: What is it and how are food, drink, and travel expenses taxed appeared first on HELPERS.

Apart from salary, employees can receive a “non-salary compensation”. The various fringe benefits or cafeteria elements offer more favorable taxation options than regular salary – this is why many employers decide to offer cafeteria to their employees.

The post Fringe benefits in Hungary – Cafeteria 2018 appeared first on HELPERS.