Starting from the middle of November 2023, wine products sold by vineyards will be exempt from representation tax in Hungary. The decision is expected to give a boost to the wine sector at the end of the year.

The post Wine products no longer subject to representation tax in Hungary appeared first on Helpers Finance.

The number of yearly tax inspections conducted by the Hungarian Tax Authority has been steadily increasing over the past few years. The most popular tax inspected continues to be VAT, since it is a major contributor to the national budget. If your company operation is compliant with regulations, you have nothing to worry about.

The post Hungarian Tax Authority conducts more tax inspections appeared first on Helpers Finance.

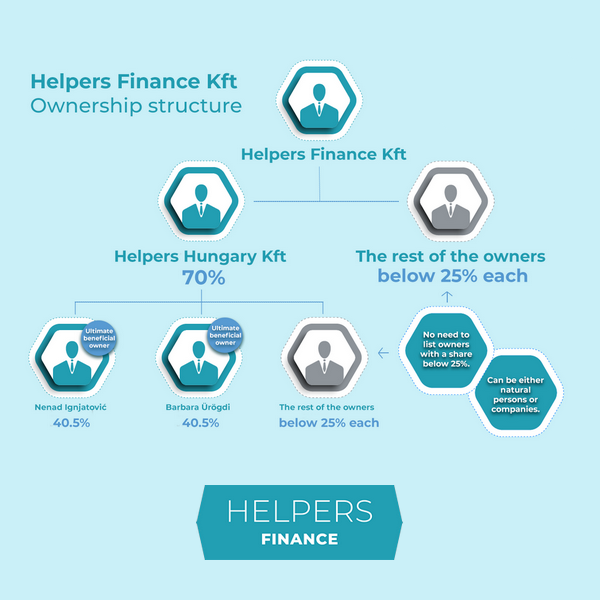

You are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of a chart that starts with your Hungarian company and ends in the ultimate beneficial owners.

The post How to present the ownership structure of your Hungarian company? appeared first on Helpers Finance.

Money left on a regular bank account pays hardly any interests, while making investments through a securities account can even increase their value, especially in a high inflation environment like that of Hungary these days.

The post What are the advantages of opening a securities account? appeared first on Helpers Finance.

Whether it is because of increased turnover or employees taking their holidays, your business might be in need of temporary workers. You have various options, just make sure to declare the employment correctly to avoid fines.

The post Summer is the season for temporary work – make sure to declare it appeared first on Helpers Finance.

CSOK, the Hungarian family housing allowance was created to support families in finding a home. Young married couples who pledge to have children are eligible for a non-refundable allowance and favorable interest rates for property purchase. Now it seems the conditions for eligibility will be severely reduced starting from 2024.

The post Apply for the Hungarian family housing allowance before it is reduced appeared first on Helpers Finance.

When you have income from interests, normally you pay personal income tax and social security contribution on those. However, if you invest in Hungarian government securities, you may not be required to pay either of those.

The post Tax benefits for government securities in Hungary appeared first on Helpers Finance.

Based on data from 2022 and H1 2023, analysts expect yearly inflation in Hungary to be reduced below 10% by December. Even in the worst case scenario, the yearly average inflation in 2023 will not be higher than 19%.

The post Expected yearly average inflation in Hungary in 2023 appeared first on Helpers Finance.

The Hungarian Tax Authority is now sending notices to businesses if the payments they made for 2022 do not match the amount they were supposed to pay, whether they are in arrears or in overpayment. If you are not sure, you can also always check your balance online.

The post Tax payment notices urging businesses to clear their debts appeared first on Helpers Finance.