KIVA

Are you planning to do business in Hungary? You have several options – you just need an idea for your operation, and find the business form that suits it best. Company formation or self-employment? VAT or no VAT? Which tax regime? Let’s give you a crash course.

The post Company setup or freelancing in Hungary? Learn the pros and cons of each appeared first on Helpers Hungary.

Are you planning to do business in Hungary? You have several options – you just need an idea for your operation, and find the business form that suits it best. Company formation or self-employment? VAT or no VAT? Which tax regime? Let’s give you a crash course.

The post Company setup or freelancing in Hungary? Learn the pros and cons of each appeared first on HELPERS.

If you were a KATA subject, you probably had to make some tough decisions over the last month or so. As 1 September, the great watershed is here, let’s have an overview of things to take care of when switching to KATA 2.0 or choosing another tax regime.

The post Checklist for KATA orphans and KATA 2.0 subjects in September appeared first on Helpers Finance.

While flat-rate taxation is a cost-effective alternative for self-employed KATA orphans from September, it is not available for limited partnerships. Instead, they may consider whether TAO, KIVA and/or EKHO are suitable alternatives for their company.

The post KATA alternatives for limited partnerships: TAO, KIVA, EKHO appeared first on Helpers Finance.

Starting from September, many current KATA subjects are losing eligibility for this tax regime. If “KATA orphans” want to continue doing business as self-employed in Hungary, they must choose another form of taxation. Flat-rate taxation is among the most cost-effective options for freelancers.

The post KATA alternative no. 1 for the self-employed: flat-rate taxation appeared first on Helpers Finance.

After new restrictions on the KATA tax regime made it impossible for many current KATA taxpayers to continue doing business under the same rules, we have compiled a set of options they can choose instead, complete with drawbacks and pitfalls.

The post Options for KATA taxpayers starting from September appeared first on Helpers Finance.

The end of May is an important time in the life of Hungarian companies. Yearly reports and taxes must be submitted by 31 May. Are you ready for the year-end closing?

The post Year-end closing at your Hungarian company appeared first on Helpers Finance.

While the 9% corporate tax in Hungary is already the most favorable option in the EU, you can further reduce what you pay in taxes with KIVA, the tax regime designed for small and medium sized companies. Let’s see if it is a good match for your Hungarian company! Are you eligible for KIVA? First …

KIVA or corporate tax? Choose the tax regime best for your Hungarian company Read More »

The post KIVA or corporate tax? Choose the tax regime best for your Hungarian company appeared first on Company Formation.

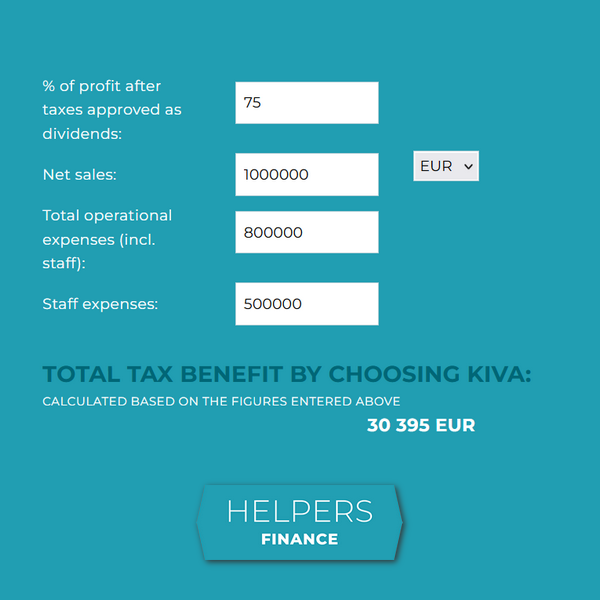

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

The post Explore the new small business tax calculator appeared first on Helpers Finance.

KIVA is a tax for small businesses in Hungary. As opposed to running an LLC and paying the “regular” taxes (9% corporate tax and various other taxes, especially on payroll), the 11% rate of KIVA includes corporate tax, social contribution tax and vocational training levy. This, combined with how the tax base is calculated, makes KIVA very favorable in certain cases. But which Hungarian enterprises can opt for this taxation structure, and when should they?

The post KIVA: a small tax for small businesses in Hungary appeared first on Helpers Finance.