Corporate Tax

The end of May is an important time in the life of Hungarian companies. Yearly reports and taxes must be submitted by 31 May. Are you ready for the year-end closing?

The post Year-end closing at your Hungarian company appeared first on Helpers Finance.

Check out our new website that offers company formation in Central Europe, compare the most important factors, and make an informed decision that will suit your business the most.

The post Company formation in Central Europe appeared first on HELPERS.

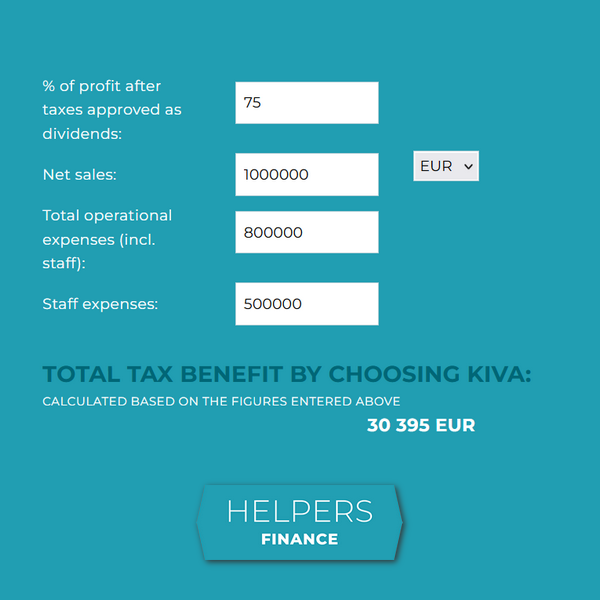

While the 9% corporate tax in Hungary is already the most favorable option in the EU, you can further reduce what you pay in taxes with KIVA, the tax regime designed for small and medium sized companies. Let’s see if it is a good match for your Hungarian company! Are you eligible for KIVA? First …

KIVA or corporate tax? Choose the tax regime best for your Hungarian company Read More »

The post KIVA or corporate tax? Choose the tax regime best for your Hungarian company appeared first on Company Formation.

The OECD is introducing a global minimum tax at 15% starting from 2023. The tax will only affect companies with a global revenue above EUR 750 million.

The post Hungarian SMEs will not be affected by the global minimum tax appeared first on HELPERS.

We have already discussed plans for the introduction of a global minimum tax. Last week, Hungary agreed to join the convention that aims to set corporate tax at a 15% minimum for international companies that have a yearly revenue above EUR 750 million.

The post Hungary has agreed to introduce the global minimum tax appeared first on Helpers Finance.

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

The post Explore the new small business tax calculator appeared first on Helpers Finance.

At 9%, Hungarian corporate tax is one of the lowest in the European Union. However, depending on its registered seat, your Hungarian company will very likely to pay local business tax as well. As opposed to corporate tax, local business tax does not exist in other countries, so it is recommended to learn what it is and how much of it you can expect to pay.

The post Local business tax: how much do you need to pay? appeared first on Helpers Finance.

Taxes in Hungary are adjusted every year, and the Parliament has recently decided about the next changes to taxation. Some of them will affect your business in Hungary – find out how!

The post Changes to taxation in Hungary in 2021 and 2022 appeared first on HELPERS.

Talks of a global minimum tax have recently become a hot topic after several international players proposed it. In May both the USA and the OECD made mentions of such a tax, and in June the G7 made a commitment towards its introduction. However, Hungary is against it, for now.

The post Global minimum tax to be introduced soon? appeared first on HELPERS.

The development tax benefit allows Hungarian SMEs realizing certain investments to decrease their corporate tax by up to 80%. The mechanism is simple: you can reduce your corporate tax by a certain portion of the amount you invested.

The post Development tax benefit for your Hungarian SME appeared first on Helpers Finance.