Child Benefits

In Hungary, the start of the year is always about updates to regulations. Business owners especially should watch out for updates that might be relevant to your business operation, although some changes are relevant to natural persons too. Below you can find a quick overview with links to more detailed descriptions. Read on!

The post 2026 changes to taxes and other relevant regulations in Hungary appeared first on Helpers Hungary.

The new year has arrived, and several changes announced throughout last year have come into force now. See our summary here and start the new year fully compliant with HR and payroll related regulations.

The post HR and payroll related changes in Hungary in 2026 appeared first on Helpers Finance.

Starting from October 1, 2025, women who are raising or have raised 3 children are eligible for a new tax exemption: they will not have to pay personal income tax anymore. There are no restrictions on nationality either. Mothers need to submit an application, which is done easiest through the employer.

The post New tax exemption for women raising three children in Hungary appeared first on Helpers Finance.

Currently there is a wide variety of work permits available depending on the job and the background of the applicants. The Hungarian work permit is in fact a residence permit given for the purpose of work, but having children in Hungary is not supposed to affect the residency status while foreign workers will also be eligible for most Hungarian child benefits.

The post Having children while on a work permit in Hungary appeared first on Hungarian Work Permit.

While the family tax benefit is being increased from July, eligibility for the tax benefit of mothers of four or more is narrowed down. As a result, payroll specialists need to pay extra attention to calculating taxes for employees this month, while the July take-home-pay of some employees will change in Hungary.

The post Changes to family related tax benefits in Hungary in July 2025 appeared first on Helpers Finance.

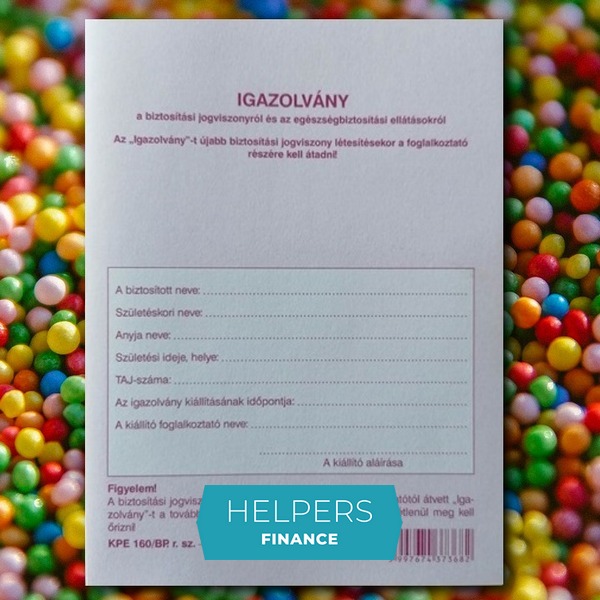

In Hungary, child-rearing is supported in various ways. One of them is a lengthy maternity leave discussed in our previous article. Another one is the system of child benefits available to new mothers and parents.

The post Child benefits in Hungary appeared first on Helpers Hungary.

If you have employees working for your Hungarian company, they will be entitled to paid time off in line with Hungarian labor law. PTO is not an option: you as an employer must make sure that your employees have taken all their PTO by the end of each year.

The post Paid time off and unpaid leave at your Hungarian company appeared first on Hungarian Work Permit.