Accountancy

Invoicing software and online invoicing tools are great to improve the accuracy of your invoices while reducing work load and promoting transparency. However, even good programming cannot replace familiarity with regulations, while you should also be on the lookout for glitches. Here, have a few examples of what to watch out for!

The post What to watch out for when using online invoicing tools in Hungary appeared first on Helpers Finance.

The minimum wage has been raised to HUF 200,000 gross, while the social contribution tax has been reduced to 13%. At the same time, personal income tax for persons younger than 25 has been abolished.

The post Salaries and payroll taxes in 2022, Hungary appeared first on HELPERS.

January is the season for New Year’s resolutions. But can that be applied to accounting and company management? Of course it can! We have compiled a list of handy tips that can make your business life easier in 2022.

The post New Year’s resolutions for your Hungarian company appeared first on Helpers Finance.

Sometimes it might happen that your accountant “disappears”: they will not answer messages and the phone, and will not continue to take care of your books anymore. Whatever the reason, it is your Hungarian company’s responsibility to make sure your accounting remains compliant with regulations.

The post What can you do if your accountant disappears? appeared first on Helpers Finance.

Last week the new minimum wages were announced. This affects not only employees earning minimum wage or receiving benefits that are calculated based on that, but also the employers who have to adjust their budget, and indirectly, prices of various goods and services.

The post Minimum wage in Hungary in 2022 appeared first on Helpers Finance.

The ongoing coronavirus pandemic has had dire effects on world economy, creating bottlenecks in supply chains, rearranging the labor market, and increasing inflation, with the effects expected to be felt well into 2022. What are the most obvious changes? Find out with us.

The post Worldwide inflation due to the pandemic expected to decrease in 2022 appeared first on Helpers Finance.

How to boost the economy during recession, like the one caused by the COVID-19 pandemic? Scandinavian countries have found a recipe that has let them remodel their economy: green taxation.

The post Green taxation trends in Europe boosting the economy appeared first on Helpers Finance.

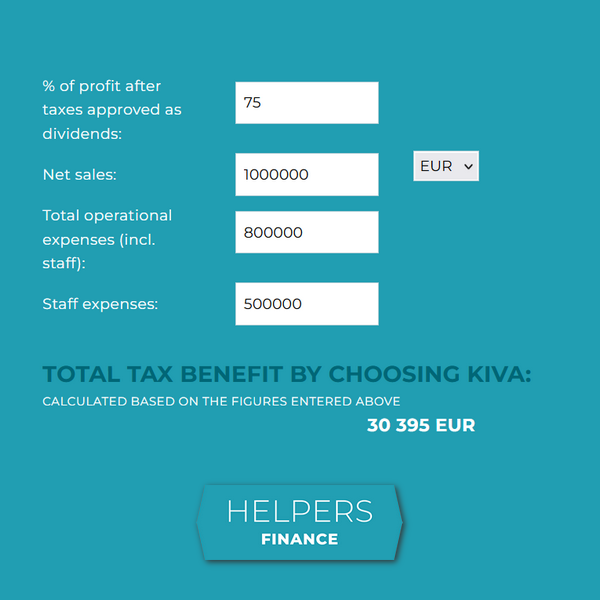

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

The post Explore the new small business tax calculator appeared first on Helpers Finance.

Climate change is happening. But what does accountancy do with mitigating its effects? Accountants are skilled at creating reports and projections, and they can help managers and investors make decisions that push development toward sustainability and reaching climate protection goals.

The post Accounting for the climate crisis appeared first on Helpers Finance.

They say it is better to give than to receive. It is certainly nice to present your business partners with something nice, but what written and unwritten rules pertain to business gifts in Hungary? Let’s find out the basics.

The post Business gifts in Hungary appeared first on HELPERS.