Business

Buying into a franchise you will be in control of your own business and develop it at your own pace while also enjoying the benefits of an established brand, a proven and successful business model, and a local partner who is just as devoted to your success as you are.

The post Should I buy into a franchise in Hungary? appeared first on HELPERS.

Buying a company is not only a convenient option, but usually requires less paperwork and offers an easier start. However, thanks to the quick administrative procedures and our well-coordinated partners, registering a new Hungarian company is much easier and quicker than buying a ready-made business.

The post Should I buy a shelf company in Hungary? appeared first on HELPERS.

According to the new taxation plans accepted by the Hungarian Ministry of Economics for 2017, corporate tax will be lowered to only 9% starting on the 1st of January 2017. This means that Hungary will have the lowest corporate tax in the European Union and the Schengen zone. The corporate tax decrease will affect small […]

The post Hungary to have the lowest corporate tax in the EU appeared first on HELPERS.

A well-made business plan includes professional and thoughtful planning in marketing, sales, finance, risk management, HR and operational management, and gives you comprehensive guidance and assistance in how to put your high level business ideas into practice. Even if you already have experience in running a business, a different country has a new set of […]

The post Do I really need a business plan? appeared first on HELPERS.

1. Doing it all alone When opening a business in Europe, there are several bureaucratic procedures you have to navigate, along with unfamiliar laws and regulations that might differ significantly from your native country. Even without the language barrier, it is daunting for anyone to sort through and take care of all the paperwork. Attempting […]

The post 4 mistakes business owners make appeared first on HELPERS.

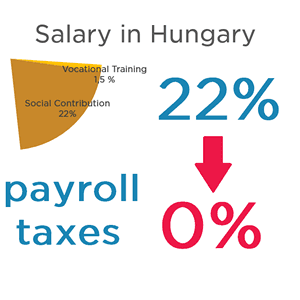

Authorities let companies reduce payroll taxes if they employ workforce who have difficulties entering the labor market. Members of the listed groups may prove as eager, skilled, and earnest employees as anyone else, while employing them grants you significant payroll tax relief.

The post How to reduce payroll taxes in Hungary? appeared first on HELPERS.

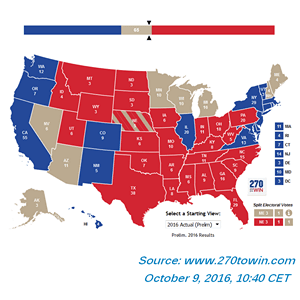

If you want to visit Europe, you only need your passport, and you will be granted entry to the Schengen zone without questions. However, if you would come to stay, that’s a different story.

The post How to immigrate to Europe from the US? appeared first on HELPERS.

In order to create an even better team out of the people working next to each other in our office, team building is essential – that’s why Helpers is going on a company retreat this weekend.

The post Team building for productivity – We are going on a company retreat! appeared first on HELPERS.

If you have ever thought of moving to Europe, Hungary is an excellent choice. Located within the Schengen zone, with easy access to the rest of the continent, Hungary also boasts a low cost of living and a dynamic, business-friendly environment. For a reasonable initial investment, you can acquire Hungarian residency and eventually citizenship (if desired) by starting a business in Hungary.

The post Business Immigration to Hungary: What You Should Know appeared first on HELPERS.

If you operate a Hungarian company, you will want to be aware of certain accounting deadlines when you should pay taxes and contributions. Your accountant will always remind you when a payment is due.

The post Company ownership in Hungary – The most important accounting deadlines appeared first on HELPERS.