Business Solutions

In order to create an even better team out of the people working next to each other in our office, team building is essential – that’s why Helpers is going on a company retreat this weekend.

The post Team building for productivity – We are going on a company retreat! appeared first on HELPERS.

Analyze your needs, choose a bank and an offer which suits them, arrange for an appointment, collect the necessary documents, and open your bank account in person. Seems easy – and it is, with our assistance.

The post How to open a bank account in Hungary? appeared first on HELPERS.

Whether you are an individual or managing a company, having a bank account and access to online banking is a must to keep tabs on your finances. In Hungary, opening a bank account is fast and easy, although you have to fulfil certain requirements.

The post Opening a bank account in Hungary – Where to start? appeared first on HELPERS.

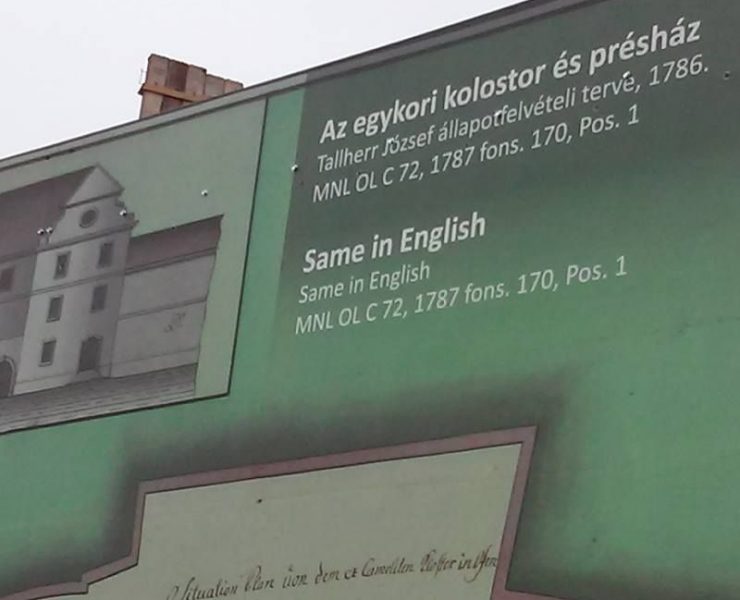

If the translation is not yet available, it is fine to enter a dummy text, indicating where you will need to insert the “same in English”. Just don’t forget to update the file when the translation is ready.

The post The same in English – Project management to the rescue appeared first on HELPERS.

Pagony is not a bookstore. It is a space where you can spend some quality time: browse books, try board games, participate in various activities – and, from next Friday on, drink a cup of coffee. – An interview with the managing directors.

The post Pagony, so much more than a bookstore appeared first on HELPERS.

This marks the beginning of just the type of fruitful cooperation Helpers promotes: the discerning clientele of Pagony will have a chance to sample coffee that is truly unique and amazing, while Barako will gain wider exposure and expand its reach by showcasing its excellent product in a whole new setting.

The post A Helpers success story: Barako café teams up with Pagony, Budapest’s top children’s bookshop appeared first on HELPERS.

Owning a Hungarian company has its perks. Still, you should always make sure you comply with local regulations, even when they change – like the share capital requirement from March 15 2016.

The post Company ownership in Hungary – Obligatory share capital increase appeared first on HELPERS.

Company ownership in Hungary is a comfortable and cost-effective way to start trading with European countries. But what do you do when you want to cease the operation of your company?

The post Company ownership in Hungary – Company Liquidation appeared first on HELPERS.

Setting up a company in Hungary is an easy and fast way for non-EU citizens to establish themselves in the European market and obtain a resident permit. A well-written business plan will do the trick for you.

The main points that we need to show in the business plan are the following:

The post Setting up a company in Hungary – The importance of business planning appeared first on HELPERS.

Having a registered seat is essential for a Hungarian company. This is where authorities will expect to find you, therefore it is crucial that a competent person is there to handle any incoming mail or enquiry.

The post Registered Seat, Virtual Office and Mail Forwarding in Budapest appeared first on HELPERS.