Taxes

In Hungary, many favorable taxation options are available to small companies and entrepreneurs, depending on the size and type of their business. KATA and flat-rate taxation are both structures that were created to reduce administration – and both will change starting from 2022.

The post KATA and flat-rate taxation in Hungary in 2022 appeared first on Helpers Finance.

Alongside the next increase to the minimum wage just announced for 2022, social contribution tax will be decreased to even out the financial burden on employers. This way minimum wage employees get a significant raise without a significant increase in their employers’ payroll costs.

The post Social contribution tax decrease in Hungary appeared first on Helpers Finance.

Last week the new minimum wages were announced. This affects not only employees earning minimum wage or receiving benefits that are calculated based on that, but also the employers who have to adjust their budget, and indirectly, prices of various goods and services.

The post Minimum wage in Hungary in 2022 appeared first on Helpers Finance.

The personal income tax refund for families, first floated in June, has recently been finalized. Anyone raising children in Hungary can expect a refund on their personal income tax paid in 2021, reimbursed early 2022. Are you eligible? How much to expect? Find out below!

The post Personal income tax refund for families in 2022 appeared first on Helpers Finance.

All companies registered in Budapest have obligations towards BKIK, the Budapest Chamber of Commerce: every year, they must provide the Chamber of Commerce with information about their activity and pay a small contribution. However, joining BKIK is optional, meaning that the yearly contribution is not a membership fee. So what is the difference between the …

BKIK membership as opposed to yearly contributions Read More »

The post BKIK membership as opposed to yearly contributions appeared first on Company Formation.

How to boost the economy during recession, like the one caused by the COVID-19 pandemic? Scandinavian countries have found a recipe that has let them remodel their economy: green taxation.

The post Green taxation trends in Europe boosting the economy appeared first on Helpers Finance.

We have already discussed plans for the introduction of a global minimum tax. Last week, Hungary agreed to join the convention that aims to set corporate tax at a 15% minimum for international companies that have a yearly revenue above EUR 750 million.

The post Hungary has agreed to introduce the global minimum tax appeared first on Helpers Finance.

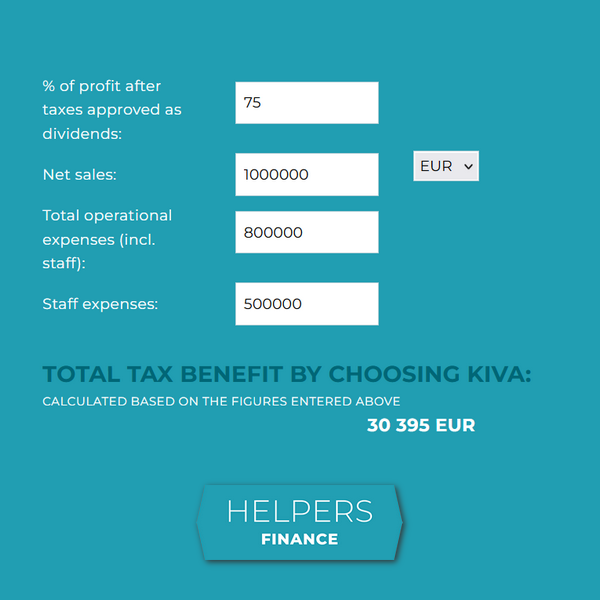

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

The post Explore the new small business tax calculator appeared first on Helpers Finance.

They say it is better to give than to receive. It is certainly nice to present your business partners with something nice, but what written and unwritten rules pertain to business gifts in Hungary? Let’s find out the basics.

The post Business gifts in Hungary appeared first on HELPERS.

At 9%, Hungarian corporate tax is one of the lowest in the European Union. However, depending on its registered seat, your Hungarian company will very likely to pay local business tax as well. As opposed to corporate tax, local business tax does not exist in other countries, so it is recommended to learn what it is and how much of it you can expect to pay.

The post Local business tax: how much do you need to pay? appeared first on Helpers Finance.