If you are an EU citizen already living in Hungary, get your EU registration card and address card as soon as possible, and cross the border more easily even during the partial travel ban.

The post How – and why – to get an EU registration card in Hungary appeared first on HELPERS.

Starting from 1 September 2020, border control is reinstated, everyone entering Hungary is examined for COVID-19 symptoms, and everyone has to quarantine for 14 days after entry.

The post Entry to Hungary starting from 1 September 2020 appeared first on HELPERS.

When moving to Hungary with your pet, your pet will need the right documentation, marking, and vaccination to enter Hungary, which you can most probably take care of at your local vet.

The post Moving to Hungary with your pet appeared first on HELPERS.

Based on 5 factors relevant for business set-up and among 70 key OECD cities, Budapest offers the most cost-friendly options for starting a business.

The post Budapest is the most affordable city to start a business appeared first on HELPERS.

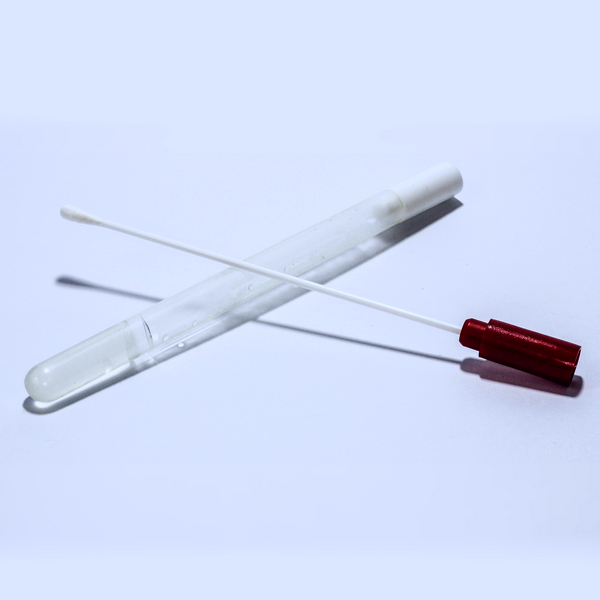

You will need two PCR tests for nasal and oropharyngeal swabs (samples taken from your nose and throat). The tests will show that at the time of taking the swab samples the coronavirus was not detectable in your body.

The post How can I escape the quarantine? appeared first on HELPERS.

The countries travellers might be arriving from are now categorized as “green”, “yellow”, or “red”, depending on how dangerous they are considered with respect to bringing COVID-19 to Hungary.

The post Entry to Hungary based on where you are coming from: green, yellow or red countries appeared first on HELPERS.

Find out which are the green, yellow, and red countries relevant for entering Hungary as of 15 July 2020.

The post Country categories for entry to Hungary – updated regularly appeared first on HELPERS.

As of 4 July 2020, the range of people who can enter Hungary is further widened. From now on, Hungarian residence permit holders can enter Hungary without police clearance if they are not infected with SARS-CoV-2.

The post New regulation lets residency holders enter Hungary appeared first on HELPERS.

Find the answer to some of the frequently asked questions we received related to our previous article on the end of the state of emergency in Hungary.

The post FAQ for the end of the state of emergency in Hungary appeared first on HELPERS.

As of 18 June, the state of emergency in Hungary is officially cancelled. Some limitations remain, like wearing a mask in public transport and in shops, and the travel ban is still only lifted partially. Resident permits and work permits that expired during the state of emergency will expire on 2 August.

The post State of emergency over in Hungary, some restrictions remain appeared first on HELPERS.