Accountancy

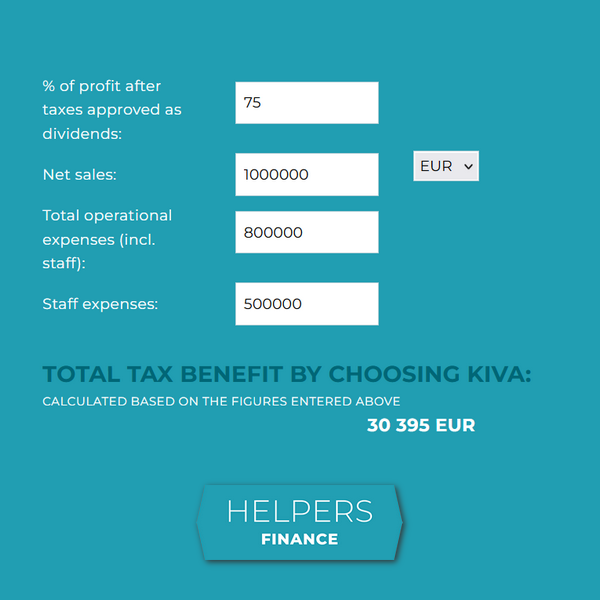

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

The post Explore the new small business tax calculator appeared first on Helpers Finance.

Climate change is happening. But what does accountancy do with mitigating its effects? Accountants are skilled at creating reports and projections, and they can help managers and investors make decisions that push development toward sustainability and reaching climate protection goals.

The post Accounting for the climate crisis appeared first on Helpers Finance.

They say it is better to give than to receive. It is certainly nice to present your business partners with something nice, but what written and unwritten rules pertain to business gifts in Hungary? Let’s find out the basics.

The post Business gifts in Hungary appeared first on HELPERS.

Automation in accounting, just in any other fields, aims at removing simple and repetitive tasks from the workload of specialists, so they can focus on tasks that require more expertise and creativity. Adding AI to the mix will be a next step that enables an even higher level of automation and increase in efficiency.

The post AI and automation in accounting appeared first on Helpers Finance.

Start-ups and SMEs usually have outsourced accounting. But what are the main benefits, and when does it makes sense to have accountancy in-house instead? There are three main factors to consider: the size, the activity, and the budget of your enterprise.

The post Outsourced accounting vs. in-house accounting appeared first on Helpers Finance.

At 9%, Hungarian corporate tax is one of the lowest in the European Union. However, depending on its registered seat, your Hungarian company will very likely to pay local business tax as well. As opposed to corporate tax, local business tax does not exist in other countries, so it is recommended to learn what it is and how much of it you can expect to pay.

The post Local business tax: how much do you need to pay? appeared first on Helpers Finance.

If you run a business, you are probably familiar with the basics of invoicing and know what to write on an invoice. But are e-invoices, PDF invoices or paper invoices the best option for you? There is more to consider than meets the eye.

The post Invoicing in Hungary: e-invoice, PDF, or paper invoice? appeared first on Helpers Finance.

Most business owners in Hungary are used to issuing and receiving invoices with value-added tax. When such an invoice is issued, the buyer must pay the gross amount, and later both parties submit a VAT report indicating the value added tax they received and paid. These two amounts determine whether the seller needs to forward any VAT to the tax authority. Reverse charge works the opposite way: the seller cannot charge VAT because it must be determined and paid by the buyer.

The post Issuing invoices in Hungary: reverse charge on VAT appeared first on Helpers Finance.

Taxes in Hungary are adjusted every year, and the Parliament has recently decided about the next changes to taxation. Some of them will affect your business in Hungary – find out how!

The post Changes to taxation in Hungary in 2021 and 2022 appeared first on HELPERS.

Whether your services are subject to VAT depends on who your customers are and where they are located. Since the applicable VAT rate also depends on the kind of services you sell, international service sales are a complex matter.

The post Selling services – when to charge VAT? appeared first on Helpers Finance.