Accountancy

Last week the new minimum wages were announced. This affects not only employees earning minimum wage or receiving benefits that are calculated based on that, but also the employers who have to adjust their budget, and indirectly, prices of various goods and services.

The post Minimum wage in Hungary in 2022 appeared first on Helpers Finance.

The ongoing coronavirus pandemic has had dire effects on world economy, creating bottlenecks in supply chains, rearranging the labor market, and increasing inflation, with the effects expected to be felt well into 2022. What are the most obvious changes? Find out with us.

The post Worldwide inflation due to the pandemic expected to decrease in 2022 appeared first on Helpers Finance.

How to boost the economy during recession, like the one caused by the COVID-19 pandemic? Scandinavian countries have found a recipe that has let them remodel their economy: green taxation.

The post Green taxation trends in Europe boosting the economy appeared first on Helpers Finance.

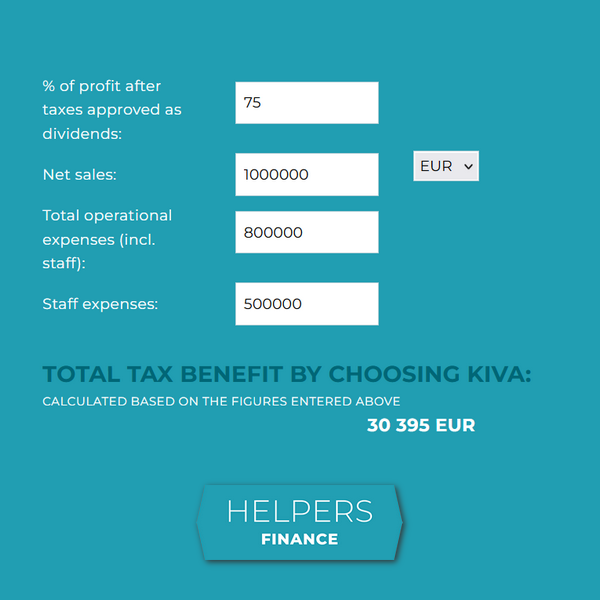

Every newly registered company in Hungary must choose a tax regime. Is the regular corporate tax or KIVA more beneficial for your company? Check out our new small business tax calculator, and let us help you make an informed decision.

The post Explore the new small business tax calculator appeared first on Helpers Finance.

Climate change is happening. But what does accountancy do with mitigating its effects? Accountants are skilled at creating reports and projections, and they can help managers and investors make decisions that push development toward sustainability and reaching climate protection goals.

The post Accounting for the climate crisis appeared first on Helpers Finance.

They say it is better to give than to receive. It is certainly nice to present your business partners with something nice, but what written and unwritten rules pertain to business gifts in Hungary? Let’s find out the basics.

The post Business gifts in Hungary appeared first on HELPERS.

Automation in accounting, just in any other fields, aims at removing simple and repetitive tasks from the workload of specialists, so they can focus on tasks that require more expertise and creativity. Adding AI to the mix will be a next step that enables an even higher level of automation and increase in efficiency.

The post AI and automation in accounting appeared first on Helpers Finance.

Start-ups and SMEs usually have outsourced accounting. But what are the main benefits, and when does it makes sense to have accountancy in-house instead? There are three main factors to consider: the size, the activity, and the budget of your enterprise.

The post Outsourced accounting vs. in-house accounting appeared first on Helpers Finance.

At 9%, Hungarian corporate tax is one of the lowest in the European Union. However, depending on its registered seat, your Hungarian company will very likely to pay local business tax as well. As opposed to corporate tax, local business tax does not exist in other countries, so it is recommended to learn what it is and how much of it you can expect to pay.

The post Local business tax: how much do you need to pay? appeared first on Helpers Finance.

If you run a business, you are probably familiar with the basics of invoicing and know what to write on an invoice. But are e-invoices, PDF invoices or paper invoices the best option for you? There is more to consider than meets the eye.

The post Invoicing in Hungary: e-invoice, PDF, or paper invoice? appeared first on Helpers Finance.