Bookkeeping

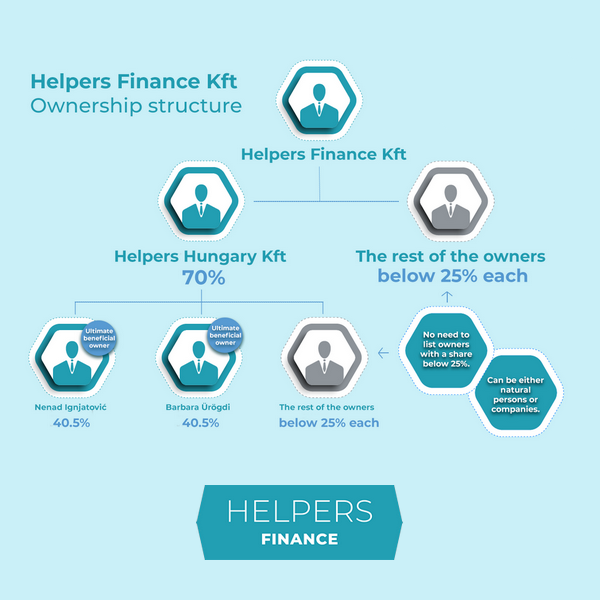

You are required to present the ownership structure of your newly created Hungarian company when you are registering it for various services. This is easiest done in the form of a chart that starts with your Hungarian company and ends in the ultimate beneficial owners.

The post How to present the ownership structure of your Hungarian company? appeared first on Helpers Finance.

Tax returns season has come in Hungary. If you are a tax resident, you will need to file your personal income tax report by 22 May. These days it is really simple: just takes a few clicks on the online platform of the Tax Authority.

The post Tax returns in Hungary in 2023 appeared first on Helpers Finance.

Are you new to business? Or maybe just to flat-rate taxation? Either way, you might wonder how and when you are supposed to first pay the local business tax, since it is normally calculated based on the tax of the previous year – and you might not have a previous year.

The post Local business tax deadlines for new businesses appeared first on Helpers Finance.

An audit is a procedure where the books of your Hungarian company are closely examined to reveal possible mistakes. Beside voluntary audits done by independent contractors, the Tax Authority can also conduct audits, so make sure your books are in order.

The post Tax audit and compliance audit in Hungary: what is the difference? appeared first on Helpers Finance.

As the owner of a Hungarian company, you can use the profit of your company for yourself by taking dividends. Before you can do that, your company will always need a balance sheet, and in some cases, an audit as well.

The post Taking dividends in Hungary – what to watch out for appeared first on Helpers Finance.

When you set up a Hungarian company, you probably expect to make money on it. But how much of the company’s revenue can you actually take for yourself? Learn the basics of Hungarian corporate taxes, and how to take dividend from your company.

The post Dividend in Hungary 101: how much do you get from your company? appeared first on Helpers Finance.

If you operate a Hungarian company, you will need an accountant to take care of booking incoming and outgoing invoices, do the payroll administration of your employees, and report data to the Hungarian Tax Authority.

The post Who can be my accountant in Hungary? appeared first on Helpers Finance.

The end of May is an important time in the life of Hungarian companies. Yearly reports and taxes must be submitted by 31 May. Are you ready for the year-end closing?

The post Year-end closing at your Hungarian company appeared first on Helpers Finance.

Since the UK has left both the European Union and the Customs Union, the UK is now officially a third country. In line with this, trading regulations has changed radically after Brexit. Read our quick guide to get up to date.

The post Trading with the UK after Brexit appeared first on Helpers Finance.

When doing business, you expect your partners to pay for your services, or provide the products you have paid for on time. However, sometimes life happens, and your company ends up with debts owed to it. Learn the techniques to mitigate risks and advance debt collection – or reduce the damage caused by irrecoverable claims. Get a full overview, complete with bad debts’ effects on taxation.

The post Debt collection in Hungary: the full picture appeared first on Helpers Finance.