Hungary is a safe haven concerning the global minimum tax. Standard corporate tax remains 9% for small and medium sized companies, while the 15% global minimum tax only affects international corporations with a yearly revenue above EUR 750 million. Read on to learn what this means for your Hungarian business.

The post Global minimum tax at your Hungarian company appeared first on Company Formation.

Hungary is a safe haven concerning the global minimum tax. Standard corporate tax remains 9% for small and medium sized companies, while the 15% global minimum tax only affects international corporations with a yearly revenue above EUR 750 million. Read on to learn what this means for your Hungarian business.

The post Global minimum tax at your Hungarian company appeared first on Company Formation.

If the registered seat of your Hungarian business is with a seat provider, there is a chance they are also acting as a delivery agent for you. Learn what the difference is and what to expect from each.

The post Registered seat and delivery agent in Hungary appeared first on Company Formation.

Moving your business to Hungary? Whether you are setting up a subsidiary to your existing business or a completely new venture, the Limited Liability company (or LLC for short) is an excellent option for starting your operation in Hungary and the EU.

The post 5+1 reasons to set up a Hungarian LLC appeared first on Company Formation.

Operating a company in Hungary? Then take a quick look at our streamlined guide of key updates to taxes in 2025. If you see something that might be relevant to your business operation, contact your accountant to discuss how to proceed.

The post Overview of Hungary’s Tax Changes for 2025 appeared first on Company Formation.

NACE, the classification of economic activities in the EU received an update. In Hungarian, it is referred to as TEÁOR’25. See if you need to do anything.

The post TEÁOR’25: latest NACE update introduced in Hungary appeared first on Company Formation.

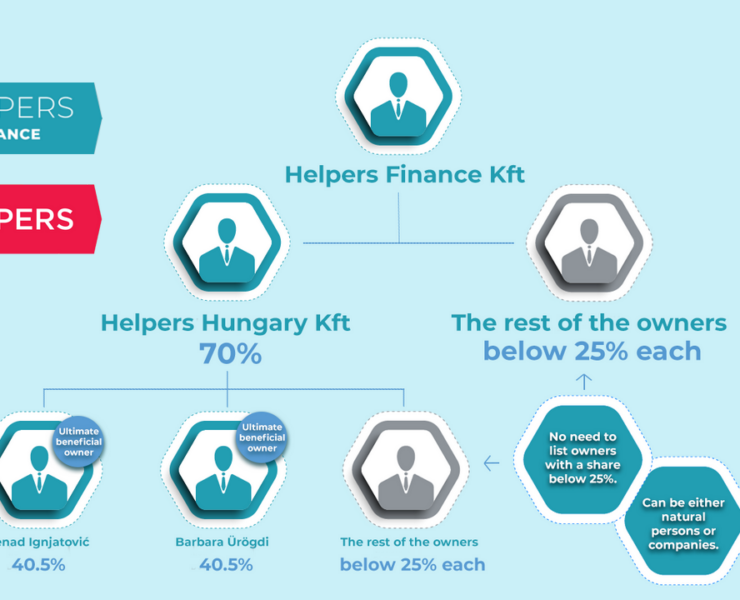

Transparency is a key value in the European Union. When you set up your Hungarian company and want to register for mandatory services, you are expected to present the ownership structure of the company in a transparent way.

The post Transparent presentation of the ownership structure of your Hungarian company appeared first on Company Formation.

Your Hungarian company will most likely be a VAT subject, which means you will have to add VAT, or Value Added Tax to your sales. You will also be paying VAT on your purchases, but you will be able to reclaim VAT later. VAT in Hungary When you are making purchases on Hungary, the sales …

How to reclaim VAT at your Hungarian company Read More »

The post How to reclaim VAT at your Hungarian company appeared first on Company Formation.

You can become an EU resident and gain visa-free access to the EU if you set up a company in Hungary. Alternatively, if you become a Hungarian resident first, you can more easily set up a company and start trading in the EU. The Hungarian guest investor program offers an excellent opportunity for that. Business …

Set up an EU company as a guest investor Read More »

The post Set up an EU company as a guest investor appeared first on Company Formation.

When you set up your business in Hungary, your company will need a name which clearly identifies it and which distinguishes it from competitors. A Hungarian company name must be unique, correct, and appropriate. What does that mean? Read on to find out.

The post Choose the right name for your Hungarian business appeared first on Company Formation.