Business Solutions

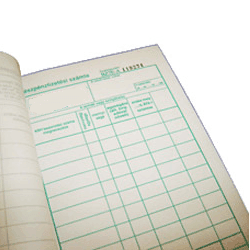

When you own a Hungarian company, it is crucial that you keep good track of your income and expenses. The regulations are quite strict, and if you fail to comply, you may expect extensive fines. However, you only have to follow a few simple rules.

The post Tracking Income and Expenses in Hungary – Accountancy quick guide appeared first on HELPERS.

In Hungary, issuing invoices is strictly regulated. For this purpose, a random piece of paper, a Word or Excel file will not be enough: you will have to issue your invoice more “officially”. Learn how it should be done.

The post Invoicing in Hungary: Booklet or software? Accountancy quick guide appeared first on HELPERS.

Taxation can be a complex matter. In order to best assist you, however, we need to understand the basics of your business operation. Still, you may find the following list of basic corporate taxes useful.

The post Hungary Taxation – Accountancy quick guide appeared first on HELPERS.

Every Hungary-based company is legally required to have an accountant or bookkeeper. In Hungary, there is no real difference between accountancy and bookkeeping, but you do need the assistance of a certified person to submit the necessary reports to the tax authority.

The post Accounting in Budapest appeared first on HELPERS.

Until March 15th, 2014 the minimum capital is HUF 500 000 (cca EUR 1,700), while after this date it will be increased to HUF 3 000 000 (cca EUR 10,000). However, this change will be a formality for most business owners because the capital will still not need to be deposited.

The post MINIMUM CAPITAL TO INCREASE IN HUNGARY – HOW WILL IT AFFECT YOU? appeared first on HELPERS.