Safe investment when war is coming your way

What is the safest investment?

Unfortunately, there is no such thing as completely “safe” or “sure” investment. Times are constantly changing, and while some sectors and investments run lower risk than others, there are no guarantees. Even professional investors do not do much better statistically (on a risk-adjusted basis) than the layperson. However, risk can already be reduced significantly if you do not put all your eggs in one basket.

Spread your investments to reduce risks

Even in times of peace, it makes sense to “diversify your portfolio”, meaning that you should keep your money in various places and in various kinds of assets. This way if one of your investments fall, you will not lose all your savings at one blow.

When war breaks out, the first instinct of many is to sell everything to have as much cash as possible. However, in uncertain times, cash is the first to lose its value. This is especially true in war, when resources are redirected from production to war efforts, and inflation skyrockets. In such a situation, assets are always more valuable than cash.

Traditionally safe assets can be less convenient during a conflict

Some traditionally safe assets include precious metals like gold, silver, or platinum, or artwork. These are assets that will always retain their value, while they are also relatively easy to move around. However, during a crisis they have some significant disadvantages:

- They are easy to steal

- Artwork is easy to damage and often difficult to hide

- They are difficult to sell if you need cash on a short notice, or you will only be able to sell them way below price

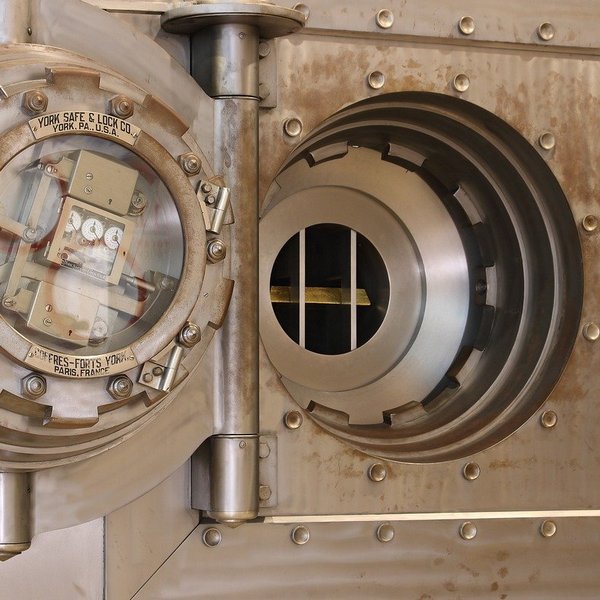

Moreover, it is difficult to decide where to keep these assets. If they are at a bank or other similar facility, they can be confiscated together with all assets of the bank in case of an invasion. If they are at a foreign facility, they remain safe, but might not be accessible to you during a crisis.

Experience shows that gold and jewelry work best as “mad money” – assets you can keep close to your person, are easy to handle, and are easy to sell in case you need cash, even if you must sell them below price. However, these should not cover the majority of your funds.

Where to put your money instead?

In a war economy, supplies are the most valuable, with a special emphasis on foodstuff. Accordingly, it makes sense to buy agricultural land, which is arable, under permanent crops, or under permanent pastures – meaning crops or animals can be grown and kept there. Whatever happens, the land remains – while a well-managed farm can be sold with significant return on investment.

Another safe are of investment consists of stocks in non-cyclical sectors, meaning businesses that operate in industries that do well regardless of what the overall economy is doing. These sectors include pharmaceuticals, chemicals, or tobacco.

Defense stocks might seem attractive, especially in the most uncertain times times right before a conflict breaks out. However, if the conflict does escalate, they might devalue as time passes, so in the long run they might not be your best choice.

During the conflict, when stocks are at their lowest price, you can try and invest in stocks of companies that might currently be weak because of the war, but will definitely recover after the conflict due to their relevancy, such as heavy industry, production, energy, or construction. While wars are fundamentally destructive, they also tend to bring innovation, which might be most prominent in these sectors in the aftermath, during the rebuilding, leading to accelerated technological progress.

The best investment is in the future

When looking for safe investment options, make sure you do not put all your eggs in one basket, and diversify your portfolio. Especially in uncertain times, the safest investments are those that can turn a profit in the long run, even if they do not seem worthwhile currently.

On a side note: there is another kind of long-term investment you might want to consider while you are pondering the viability of your ventures: funding social programs. Improving the standards of living and the level of education of the general population lets the people aided contribute more to the community while local spending power increases and both public safety and the business environment improves. An excellent example of this is the work done by the Dollywood Foundation started by U.S. singer Dolly Parton in the 1980s.

Find the right partners

Wherever you decide to invest, it is crucial that you work with trusted partners, whether they are banks, stock brokers, or real estate agents. The Helpers Team has been supporting foreigners in Hungary as a one-stop-shop for everything related to business and residency for more than 15 years, assisting hundreds of satisfied clients. Helpers Finance handles accounting and bookkeeping for small and middle-sized companies to make sure all their ventures remain compliant with law, while decision making is supported by precise and timely reports.

Can we assist your business in Hungary? Contact us today in email or on the phone (+36.1.215.0712), and let us know how we can help you.

Did you like this article? Follow us of Facebook to never miss an update.

DISCLAIMER: The information on this page is provided as general information only and it reflects the personal opinion of the authors. Nothing on this website constitutes investment advice or an investment offer as defined by Act CXXXVIII of 2007 (“Investment Service Act”), 4.§. (8) and (9). The content should not be used for financial or investment decisions, and it is not a personalized investment analysis. The information is provided without warranty of any kind. The authors, publishers and editors take no responsibility for any direct and indirect damage resulting from the use of the content of this site.

The post Safe investment when war is coming your way appeared first on Helpers Finance.