Invoicing

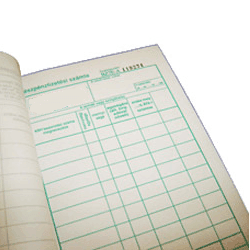

A properly issued invoice is essential for keeping your company compliant. Without it, you might be faced with being charged extra hours for accountancy, tax audits and even fines. Options for issuing invoices in Hungary In many countries, invoices can be issued by Word or Excel. However, Hungarian companies must either use an official invoice […]

The post Why should I use an invoice booklet in Hungary? appeared first on HELPERS.

A properly issued invoice is essential for keeping your company compliant. Without it, you might be faced with being charged extra hours for accountancy, tax audits and even fines. In many European countries, invoices can be issued by Word or Excel. However, Hungarian companies must either use an official invoice booklet or an invoicing software licensed […]

The post Why should I use an invoicing program in Hungary? appeared first on HELPERS.

Your accountants file a monthly or quarterly VAT report on your behalf. The frequency of VAT reports depends on your trade volume or activity. The report is filed by the 20th of the month following the relevant month or quarter. If your VAT reclaimable is more than your VAT payable, you can reclaim the difference in the VAT amount from the Tax Authority.

The post How do I reclaim VAT in Hungary? appeared first on HELPERS.

The rules and regulations on issuing an invoice set by the Hungarian Tax Office are stricter than in many European countries. Keeping the following points in mind, you’ll be able to easily conform to the regulations and avoid Tax Office fines. Basic data First, you need the basic data of the buyer: their official company […]

The post How do I issue an invoice? appeared first on HELPERS.

If you buy supplies or equipment that you need for your company’s operation in Hungary, you can write these off as company-related expenses, which decreas the company tax you have to pay at the end of the fiscal year. But be careful: to be able to do this, you need to get a fiscal invoice […]

The post How do I get a fiscal invoice? appeared first on HELPERS.

In Hungary, spending company money is strictly regulated. If you buy things for your company, you simply need an invoice. If you want to buy things for yourself, you take salary or dividend. Let us show you the basics.

The post How to spend company money – Employment in Hungary appeared first on HELPERS.

When you own a Hungarian company, it is crucial that you keep good track of your income and expenses. The regulations are quite strict, and if you fail to comply, you may expect extensive fines. However, you only have to follow a few simple rules.

The post Tracking Income and Expenses in Hungary – Accountancy quick guide appeared first on HELPERS.

In Hungary, issuing invoices is strictly regulated. For this purpose, a random piece of paper, a Word or Excel file will not be enough: you will have to issue your invoice more “officially”. Learn how it should be done.

The post Invoicing in Hungary: Booklet or software? Accountancy quick guide appeared first on HELPERS.

When you start your company in Hungary and issue your own invoices towards your clients, you will charge VAT only towards individual (retail) buyers. However, if you are an international trader, you may not charge VAT at all.

The post Hungarian Zero Vat Invoices – Accountancy quick guide appeared first on HELPERS.